Zimbabwe’s political leadership belongs to the old order; it’s time they were replaced by new leaders like Zambia’s Hakainde Hichilema

Introduction

In 2025 Maia Sandu, Moldova’s President was nominated The Telegraph’s World Leader of the Year. In a David-and-Goliath struggle between Putin, President of Russia and Moldova, a poor country of just 2.4 million people battered by an economic crisis brought upon them by the Ukraine war.

There should have been only one winner, yet Moldova prevailed.

The Telegraph’s shortlist included Javier Milei (Argentina) Giorgia Meloni (Italy) Ahmed al-Sharaa (Syria) and one contender from southern Africa, Hakainde Hichilema, President of Zambia. Much of the information that follows is from Ben Farmer’s article in the Daily Telegraph.[1]

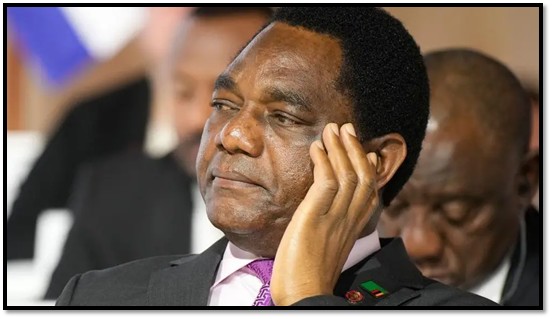

Ben Farmer writes, “Since he won the election four years ago, the 63-year-old former cattle herder has set his country on a remarkable turnaround from being a basket case towards being an economic model pupil…Judges noted that in his four years in power, the president had been a model of economic probity despite the upheaval to aid funding brought by the election of Mr Trump.”[2]

Africa is awash in debt

Zimbabwe, like most African countries, faces a debt squeeze as most commercial and institutional lenders, like the IMF, refuse to make further loans and the interest these countries are paying – some are not – means they have cut back on their social commitments like education and health. In Zimbabwe’s case this debt crisis has been a severe setback for the population that has lasted for decades throughout Robert Mugabe and Emmerson Mnangagwa’s regimes.

An article in The Conversation states, “Over half of African countries are either in debt distress or at risk of being in distress. More than half of Africa's population live in countries that are spending more on servicing their debt than on health and/or education.” Many African countries are using more foreign exchange to pay their external creditors than they received in new debts that could be used to finance their development.[3]

Who is Hakainde Hichilema?

Born in the Monze district in southern Zambia, he herded cattle and walked to school barefoot before attending the University of Zambia on a government bursary. He later studied business and finance at the University of Birmingham.

His rise to wealthy businessman was rapid as he became head of the Zambian operations of Coopers & Lybrand – later part of PwC – and Grant Thornton, at the same time making his fortune in finance, property, ranching, healthcare and tourism, and now owns one of the country’s largest cattle herds.

Hakainde Hichilema, President of Zambia

How did he get to be President of Zambia?

His political rise was not so straightforward. Only after five unsuccessful attempts to be elected did he beat then President Edgar Lungu by more than a million votes in an August 2021 landslide win

As opposition leader he was arrested 15 times and in 2016 he was charged with treason for allegedly failing to give way to the presidential motorcade, spending four months in a maximum-security jail before charges were dropped.

Since he won the election four years ago, the 63-year-old former cattle herder has set his country on a remarkable turnaround from being a basket case towards being an economic model pupil.

Hakainde Hichilema, now Zambia’s president, is often known by his initials HH and the nickname “Bally” meaning “father.”

Zambia’s situation when he came to power

Zambia’s debt situation was pretty dire at this time. In November 2020, the year before Mr Hichilema’s win, the country became the first African nation to default on its debt repayments during the Covid pandemic. This was followed by a severe El Niño drought that crippled two more of its economic pillars, agriculture and hydroelectric power and so severely affected the country’s revenue that government salaries were a year in arrears.

His election in 2021 was partly based on a promise to tackle the country's financial woes, estimated at £9.9bn inherited from his two predecessors, Michael Sata and Edgar Lungu, who had allowed Zambia to take on significant loans to finance infrastructure projects. Though some of that money was invested, it is thought that a lot was lost to corruption.[4]

HH said, “We inherited a government and a country which was basically a basket case that had failed to meet its obligations…Mountainous interest payments were diverting money away from basic services and stifling growth. Restructuring the debt was a key manifesto pledge…We defined [the debt] as a python, wrapped around our necks, we couldn’t breathe properly, around our chest, our ribs, and the legs. That is why we set out to do what we did…The debt was holding back everything the country did…There’s no doubt about it; the debt was sitting on every growth agenda we put in place. We were not able to attract capital, investment, the mines were going down.”

Despite these handicaps, Zambia has managed a drawn-out debt revamp with 94% now restructured which has sharply cut repayments and given the government much-needed breathing space. Economic growth in 2025 is tipped to be about 5.8% and about 6.4% in 2026. The mining industry is now expected to raise copper output by one million tonnes a year by 2026. According to Mining Technology’s parent company, GlobalData, copper production in Zambia fell from 800,000t in 2021 to 792,000t in 2023.[5]

Photo: James Oatway, Panos. Hakainde Hichilema, President of Zambia

His achievements since being appointed President

Hakainde Hichilema has stabilised the Zambian economy by:

Negotiating a sensible restructuring of Zambia’s debt. A bailout agreement has been reached with the International Monetary Fund (IMF) with Zambia needing to restructure its debt to unlock much-needed funds. Zambia will be granted an extended repayment time over 20 years, including a three-year grace period with interest-only payments.[6]

HH's other achievements include:

- Promoted government fiscal prudence

- Cleaned up corruption in government and para-statal institutions

- Making Zambia’s copper mining industry attractive to investors with output forecast to increase annually to three million tons by early next decade.

- Stayed neutral between the two superpowers, America and China

- Dealing with the cut-off of aid from the USA following Trump’s election. Like many African nations, Zambia had relied heavily on health aid from Washington, which funded 80% of the country’s anti-HIV programmes. Much of that has now been scrapped.[7] HH told Ben Farmer, “It is basically a wake-up call…We in Zambia, we on this continent, have been sleeping on duty. It is our duty to ensure service delivery to our population.”

- in 2022, Zambia also removed fees for all public primary and secondary schools, bringing an estimated two million pupils back to school. Thousands of new teachers are being hired to deal with the resulting overcrowding in classrooms.[8]

Zambia is the object of this intense diplomatic courtship by the world’s two superpowers

Farmer writes that HH has proved to be a deft operator, walking a geopolitical tightrope between East and West. “If I am in Beijing, I am not against Washington. If I am in Washington, I am not against Beijing. And in Beijing, I am not against London.”

Earlier in 2025 as part of his immigration crackdown, Trump put Zambia on a list of those facing travel restrictions and visitors to the USA must pay a visa bond of up to $15,000 (£11,000) Despite this Hichilema said Trump should not turn his back on Africa. He said, “First, we respect what Trump is doing. He says America first. Who should blame him for that?...But America engages with the rest of us. That’s why we are saying that while America comes first, because of America’s position, they have to deal with the rest of the world.”

China has significant investment in Zambia’s copper resources

China has long invested heavily in Zambia, which is Africa’s second-largest copper producer after the Democratic Republic of Congo (DRC) and China is the country’s largest creditor.

In November 2024, the Zambian government said a new body, the Chinese Mining Enterprise Association in Zambia, will inject up to $5 billion into Zambia's copper industry by 2031 to increase the production of copper and cobalt.[9]

The Zambian Mines and Minerals Development minister, Paul Kabuswe said, "The formation of this association will serve as a platform for Chinese mining companies operating in the country to harness cooperation between the government and the investors…We have taken strategic steps already to revamp the mining industry especially to increase copper output to achieve our 3Mt / year target by 2031 and... [organizing] miners under this umbrella will help us deliver our dream."

As Africa's second-largest copper producer, Zambia is seeking to capitalize on the global energy transition which has generated higher demand for critical minerals such as lithium, cobalt and copper.

Zambian copper destined for export to China

Environmental hazards caused by Chinese mining companies

On 18th February 2025, a tailings dam that stores waste water from copper mining operations broke, releasing more than 50 million litres of waste into Mwambashi River, a tributary of the Kafue River, a major tributary to the Zambezi and the largest and longest river lying entirely within Zambia. The copper mine, operated by Chinese owned company Sino-Metals Leach Zambia is located in Kitwe District in Zambia’s Copperbelt Province.

Local people say the collapse of the tailings dam was caused by numerous factors, including engineering failures, construction flaws and operational mismanagement. The highly acidic effluent led to massive losses of fish, damage to crops and cutting off of water supply to communities in Kitwe town and its environs, posing serious risks to human and animal health. It is worth noting that about 60% of Zambia’s population of 20 million people depend on the Kafue River Basin for irrigation, fishing, and industrial use.

The spill from Sino-Metals Leach Zambia tailings dam

The railway signals the geopolitical contest between East and West

Li Qiang, premier of China, used a visit to sign a £1.4bn deal to refurbish and reopen the Tanzania-Zambia Railway Authority (Tazara) line, which was built by China in the 1970’s, the Tazara railway runs from Dar es Salaam through Tanzania’s southern highlands and across the border into Zambia’s copper provinces, finally pulling into the town of Kapiri Mposhi some 1,860 kilometres (1,156 miles) away. Originally built to take copper exports and fuel imports through Tanzania, the upgrade is hoped to boost freight volumes from 100,000 to 2.4 million tons per year.

Heading in the opposite direction, the US and the EU are funding the rival £3.7bn Lobito Corridor. This will link Zambia’s copper belt and Congo-Kinshasa’s mineral-rich Katanga region with Lobito port on Angola’s Atlantic coast and involves the rehabilitation of the existing Benguela railway, partially destroyed during the Angolan civil war, and the extension of the line through Zambia's North-Western and Copperbelt provinces to Chingola.[10]

Currently most of Zambia’s mineral exports go via ports on Africa's eastern and southern coasts: Dar es Salaam in Tanzania, Beira in Mozambique and Durban in south Africa. However this relies heavily on trucking with journeys taking several weeks. The Lobito Corridor, once the railway is completed, would provide a quicker, cheaper and more reliable export route. That this route is facing the Atlantic Ocean, i.e. towards the US and Europe makes them hope they will get easier access to critical raw materials and diminish the Chinese dominance in the region's mining sector.

Zambian President Hakainde Hichilema (L) and his Zimbabwean counterpart Emmerson Mnangagwa (R)

Lessons Zimbabwe can learn From Zambia's economic reforms

1. Address debt decisively - Zambia faced a crippling debt crisis, with government salaries in arrears and the country defaulting on repayments. They changed things around by making debt restructuring a top priority, negotiating with creditors and leveraging international frameworks to reduce the debt burden. This was paired with a commitment to fiscal prudence and cleaning up government institutions, restoring investor confidence and stabilising the economy.

Zimbabwe can benefit from transparent well-structured debt negotiations and a focus on fiscal discipline and by engaging with international creditors to seek relief or debt restructuring where possible and ensuring government spending is transparent and efficient. These are all critical steps towards economic recovery.

Zimbabwe, like Zambia, faces a significant external debt burden. However, Zimbabwe's debt negotiations are complicated by limited bargaining power with a history of unfavourable loan agreements particularly with China. Without robust management systems and accountability, Zimbabwe risks falling into a debt trap.

2. Revitalise key sectors with investor friendly policies - Zambia's turnaround was driven by revitalising its mining industry, especially copper. The government made the sector attractive to investors, resulting in new investments and a surge in production. Ambitious targets were set to triple copper output and the administration worked to create a stable investor friendly environment.

Zimbabwe, with its rich mineral resources can revitalise key economic sectors by focusing on creating a stable regulatory environment and setting clear, ambitious targets for growth in mining and other key sectors.

A major obstacle is the general perception and reality of the ZANU-PF’s government mismanagement and corruption. Internal surveys and studies show that many Zimbabweans blame internal governance failures, rather than external sanctions, for the country's economic woes. Corruption undermines public trust, deters investment and hampers the effective implementation of reforms.

3. Balance international partnerships - Zambia skilfully balanced relationships with both China and the US securing investment and aid from both sides without alienating either country; this pragmatic approach allowed Zambia to benefit from global competition for its resources.

Zimbabwe can adopt a non-aligned pragmatic foreign policy and balance international partnerships engaging with multiple global partners to maximise investment and development opportunities and at the same time safeguarding national interests.

While some ZANU-PF officials blame sanctions for economic difficulties and as a scapegoat, the reality is that Zimbabwe has underlying structural issues. The solution is a need for genuine reform.

4. Ensure reforms are inclusive - Zambia's macroeconomic indicators improved whilst Hichilema acknowledged that many citizens are still being left behind. He emphasised the importance of translating national recovery into tangible improvements in daily life of Zambian citizens in areas such as job creation, education and social services.

Zimbabwe’s economic reforms must be inclusive ensuring they benefit ordinary citizens. Zimbabwe should ensure that growth and recovery efforts are felt at the grassroots level addressing inflation, unemployment and access to essential services such as health and education.

Zimbabwe's land reform programme, while addressing historical injustices, led to instability in the agricultural sector. Disrupted land tenure, lack of investment and reduced productivity have made it difficult to restore agriculture as a driver of economic growth.

5. Tackle corruption and strengthen institutions - Zambia's reforms included anti-corruption measures and institutional strengthening, which helped restore public trust and improve the business environment.

Zimbabwe must build strong, transparent institutions that tackle corruption robustly and are essential for sustainable development and attracting investment.

Zimbabwe suffers from weak institutions and rule of law. Effective reforms will require strong, transparent institutions and a reliable legal system. Zimbabwe's institutions have been weakened by years of political interference and ZANU-PF patronage, making it challenging to enforce fiscal discipline, combat corruption and attract investment.

6. Political instability and disputed elections – this has eroded public confidence and created distrust in the government and its institutions. Without broad based support and political will even well-designed reforms may fail to gain traction or be reversed by future administrations.

7. Inclusive growth and social equity as in Zambia, is largely absent. Therefore macroeconomic improvements do not always translate into better living standards for ordinary citizens. Zimbabwe faces high unemployment, inflation, and wide-spread poverty. Ensuring that reforms benefit all segments of society, not just ZANU-PF elites or urban populations is vital. Reforms will continue to be a persistent challenge.

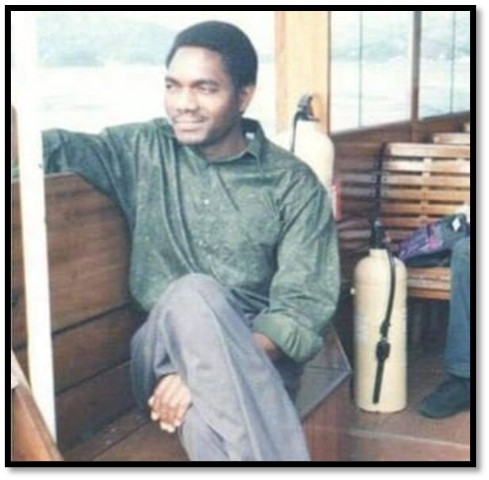

Hakainde Hichilema rose from being a cattle herder to president of Zambia

References

Danny Bradlow. Africa has a debt crisis: momentum from G20 in South Africa can help find solutions, The Conversation, 16 Nov 2025. https://theconversation.com/africa-has-a-debt-crisis-momentum-from-g20-in-south-africa-can-help-find-solutions-269004

Ben Farmer. Africa’s ‘pretty girl’ caught in the Trump-Xi power tussle. Zambia’s Hakainde Hichilema has turned his country into a prize both superpowers covet. The Telegraph, 27 December 2025. World Leaders of the Year: Hakainde Hichilema of Zambia

BBC News. 23.06.2023. Zambian President Hichilema's $6bn debt deal hailed as 'historic.' https://www.bbc.co.uk/news/world-africa-65997830

Namala Doreen. New Chinese mining body to invest $5 billion in Zambia to boost copper production. S&P Global. 13 Nov 2024. https://www.spglobal.com/energy/en/news-research/latest-news/metals/111324-new-chinese-mining-body-to-invest-5-bil-in-zambia-to-boost-copper-production

Kennedy Gonwe. BBC News, 16 Sept 2025. Chinese-linked mining firms sued over 'ecological catastrophe' in Zambia.. https://www.bbc.co.uk/news/articles/cy7p51l60rro

[2] Africa’s ‘pretty girl’ caught in the Trump-Xi power tussle. Zambia’s Hakainde Hichilema has turned his country into a prize both superpowers covet.

[3] Africa has a debt crisis: momentum from G20 in South Africa can help find solutions

[4] Zambian President Hichilema's $6bn debt deal hailed as 'historic.' https://www.bbc.co.uk/news/world-africa-65997830

[5] Source: https://www.mining-technology.com/news/zambia-could-raise-copper-production-to-1-million-tonnes-by-2026/?cf-view&cf-closed

[6] Zambian President Hichilema's $6bn debt deal hailed as 'historic. https://www.bbc.co.uk/news/world-africa-65997830

[7] Africa’s ‘pretty girl’ caught in the Trump-Xi power tussle. Zambia’s Hakainde Hichilema has turned his country into a prize both superpowers covet.

[8] Ibid

[9] New Chinese mining body to invest $5 billion in Zambia to boost copper production

[10] For information on the construction of the railways see The Beira and Mashonaland Railway – the Contractor’s stories under Manicaland Province on the website www.zimfieldguide.com